Excuse or Cause: Central Bank sanctions and fluctuating dollar

Iran’s foreign exchange market is facing tough times. Following Obama’s sanctioning of Iran’s Central Bank, the dollar exchange rate soared to 17,000 rials for every dollar; albeit that the new sanctions wouldn’t take affect for two months. Many in the Western media have interpreted the swift rise in the exchange rate to be a by-product of the sanctions on Iran’s Central Bank. However, the reality is that despite US efforts, which its European and Asian allies have supported, fluctuation in currency prices in Iran cannot be caused directly by the sanctions. IRD examines the rise in currency exchange rates with Dr. Mahdi Taghavi, professor of Allameh Tabataba’i University and renowned economist:

IRD: During the past few days, how much did the new sanctions affect the dollar exchange rate?

MT: Indeed, Obama’s imposed sanction on Iran’s Central Bank is a significant issue that will affect Iran’s economy, but the issue with the dollar is not related to the sanction. The speculators in Iran’s currency market anticipate such events to create such environments; by reducing the dollar flow in the market to increase demand. They predict that sanctions may result in a dollar shortage in Iran, therefore by reducing supply they create higher demand within the market in order to maximize personal profit.

IRD: So some people have used the sanction on the Central Bank as an opportunity to profit?

During times like this there are some speculators and dealers who predict a drop in the next volume of dollars supplied to the market. Therefore, in order to increase demand, they will buy and keep a large volume of dollars that they will hold until the rates rise.

IRD: Therefore, as well as having foreign reasons, the rising price of dollars in Iran is also the result of such dealings within the Iranian market.

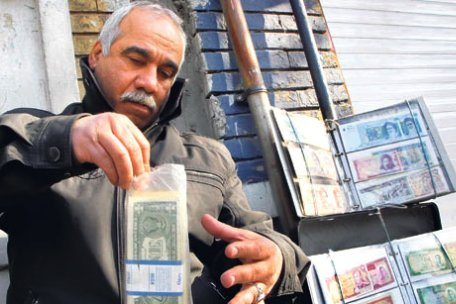

Internal chaos is always present in the market. The currency market is a “black” market in Iran and there are dealers and speculators who are solely making a living out of events like these. If these people weren’t involved in the currency market, fluctuation would not happen. This is similar to what happened to the gold market in Iran; a small group of individuals entered the market with huge capital solely motivated by profit; this will have a negative impact on the market as a whole. Of course there are high risks involved in doing business like this.

IRD: Can you expand further please?

People with lower incomes do not need dollars; it is the increased price of imported goods that affects people with low income. Where as these dealers normally have expenses in dollars.

IRD: What strategy should the government adopt to control the market?

I don’t believe the government should get involved. The Central Bank has already injected cash into the market. The only thing that happened was that these dealers made even bigger profits from the availability of capital in the market. Without government intervention they will realize that their activities will not radically increase the price of dollars in the market, therefore they may invest in another niche market.

IRD: In other words, sanctions on Iran’s central bank do not have an immediate effect on Iran’s economy?

The new sanctions will take affect in two months; until then there are no problems regarding money transfers. The only things that could have such an immediate impact on the currency market are black market dealers and speculators.

IRD: How do high dollar prices affect us, and how long do you think this problem will go on?

It cannot be predicted and the market depends on this group’s behavior. If they predict a rise in the dollar market, they will carry on holding back, reserving their dollars-- otherwise they will sell before the price drops.

IRD: Does the government have a solution to this problem?

Yes, the sudden rush of these dealers to the currency market should have pushed the dollar price even higher than what it is now. The Central Bank’s early intervention however, helped deflate the current situation. Yet, the dealers are ultimately the ones who profit.

IRD: So if the Central Bank gets involved once more, the dollar rate will drop in the market?

It will decrease, but the dealers will not sell their dollars and will carry on buying at lowered prices. The bad cycle will the carry on.

IRD: In your opinion, is there anyway to control these fluctuations?